Your LOCAL Roofing, Siding, Attic Insulation, & Gutter Experts

Financing Options Available

Ask About Our Referral Program

(937) 746-7377

Hours:

Request an Estimate

Hero Request Form

Thank you for contacting us.

We will get back to you as soon as possible

Please try again later

2nd Generation Roofers in Springboro, OH

Experienced, Trusted, Customer-Focused

Professional Roofing Services You Can Rely On, Since 1995

Your roofing system is your home's first line of defense, and it's important to keep it in great shape to maintain the integrity of your property. Rembrandt Roofing & Restoration has experienced and professional roofers homeowners in the Dayton region can trust to deliver quality workmanship and exceptional customer service. Whether you need your roofing shingles replaced or an entirely new roof installed, we've got you covered. Rembrandt Roofing & Restoration has been serving Springboro and the surrounding areas for years, so you can rest assured that your home is in the right hands when you choose to work with us.

Have Peace of Mind With Our Lifetime Warranties

As the top roofers in Springboro, OH, Rembrandt Roofing & Restoration goes above and beyond to provide you with an excellent customer experience. We understand that your roofing system is a serious investment, and roofing damage can be expensive to repair when unexpected. That's why we offer various financing options to make your roof repairs or replacement as affordable as possible. Moreover, unlike other roofers in Springboro, OH, our team provides a lifetime warranty on roofing materials and workmanship, so you can have peace of mind knowing your roofing system is protected.

Contact Us Today for a FREE Estimate

When you need roofing maintenance, repairs, or replacements, Rembrandt Roofing & Restoration is there for you. We're committed to ensuring your satisfaction is always guaranteed. We even provide FREE estimates on every one of our services, so you can rest easy knowing there are no unexpected costs or fees. If you're ready to get started working with our professional roofers, don't hesitate to reach out to us today.

Gutter Replacement & Repair Experts

Protect your home's foundation with our durable gutter installation services. We can repair your current gutters and downspouts or install new ones with the latest gutter guards. Call us today and get your FREE quote!

100 Roofs in 2024 Charity Challenge

From regular roof maintenance to emergency roof repairs, you can rely on Rembrandt's experienced roofing contractors in Springboro, OH for outstanding service. We also handle insurance claims from storm damage.

James Hardie Preferred Contractors

Upgrade the look and value of your home with new siding. Choose from vinyl, fiber cement, stucco, cedar, stone and brick, aluminum, and steel siding options. We offer a lifetime warranty on materials and workmanship.

Is Your Attic Insulation Saving You Money?

A well-insulated attic can help you save on your energy bills. Our insulation options include fiberglass batts and blown-in loose fill. Upgrade your home's energy efficiency with our help.

Here's what our satisfied customers are saying...

OUR MISSION STATEMENT

At Rembrandt Roofing & Restoration, we install, repair and replace your home's roof, siding, gutters, and more with a solid commitment to doing so in the most reliable, dependable, honest, and trustworthy manner with the highest quality materials and warranties available while providing a fun, friendly, and caring work environment for our employees, honoring our family tradition of over 20 years to protect your family and ours.

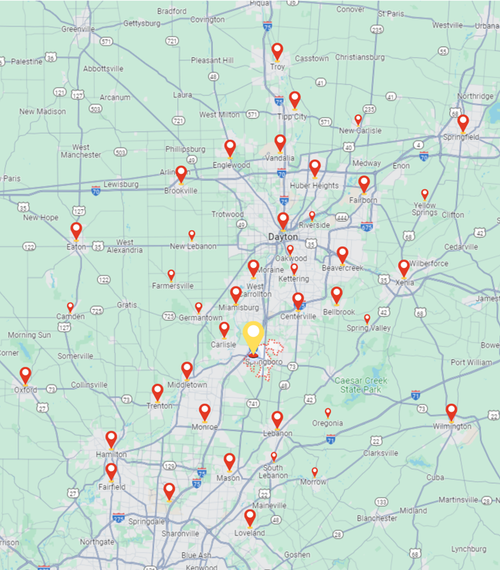

Rembrandt Roofing Project & Service Area:

- Beavercreek, OH

- Bellbrook, OH

- Brookville, OH

- Centerville, OH

- Clayton,OH

- Dayton, OH

- Eaton, OH

- Englewood, OH

- Fairfield, OH

- Farmersville, OH

- Franklin, OH

- Germantown, OH

- Hamilton, OH

- Huber Heights, OH

- Kettering, OH

- Lebanon, OH

- Liberty Township, OH

- Mason, OH

- Miamisburg, OH

- Middletown, OH

- Monroe, OH

- Moraine, OH

- Morrow, OH

- New Carlisle, OH

- Oakwood, OH

- Oregonia, OH

- Oxford, OH

- Riverside, OH

- South Lebanon, OH

- Spring Valley, OH

- Springboro, OH

- Springfield, OH

- Tipp City, OH

- Troy, OH

- Vandalia, OH

- Waynesville, OH

- West Carrollton, OH

- West Chester, OH

- Wilmington, OH

- Yellow Springs, OH

- Beavercreek, OH

- Bellbrook, OH

- Brookville, OH

- Centerville, OH

- Clayton,OH

- Dayton, OH

- Eaton, OH

- Englewood, OH

- Fairfield, OH

- Farmersville, OH

- Franklin, OH

- Germantown, OH

- Hamilton, OH

- Huber Heights, OH

- Kettering, OH

- Lebanon, OH

- Liberty Township, OH

- Mason, OH

- Miamisburg, OH

- Middletown, OH

- Monroe, OH

- Moraine, OH

- Morrow, OH

- New Carlisle, OH

- Oakwood, OH

- Oregonia, OH

- Oxford, OH

- Riverside, OH

- South Lebanon, OH

- Spring Valley, OH

- Springboro, OH

- Springfield, OH

- Tipp City, OH

- Troy, OH

- Vandalia, OH

- Waynesville, OH

- West Carrollton, OH

- West Chester, OH

- Wilmington, OH

- Yellow Springs, OH

Sign Up for Special Offers & Discounts

New Person Signed Up for Email Marketing

Thank you, your information has been submitted and we will contact you shortly.

Rembrandt Roofing and Restoration

Please try again later.

Text

Msgs may be autodialed. Consent to texts not required to purchase our svcs. Msg. and data rates may apply.

VISIT US

HOURS

HOURS

CONTACT US

Calls answered from 7am-7pm Daily

Share On: